(单词翻译:单击)

中英文本

America's presidential election

美国大选

Braced for impact

准备就绪

How investors are hedging against the risk of post-election chaos

投资者如何对冲选举后混乱的风险

Election years are not often the best times for stockmarket investors. Over the past 90 years shares included in the S&P 500, an index of America's biggest firms, have returned an average of about 8.5% a year. The twelve months leading up to each of the 22 presidential elections in that time have been leaner affairs, returning just 6%. Investors tend not to care whether the victorious candidate is Democratic or Republican, but they do like familiarity—returns are a shade higher in years when incumbents are returned to office. The democratic cycle, for all its virtues, tends to bring with it a dose of uncertainty—first about who will win and then about what that victor will do. And uncertainty tends to make financiers nervous.

对于股市投资者来说,选举年通常不是最好的时机。在过去的90年里,包括标普500(美国最大公司的指数)在内的股票平均年回报率约为8.5%。在这22届总统选举之前的12个月里,每一届的选举都是比较轻松的,回报率只有6%。投资者并不关心获胜的候选人是民主党人还是共和党人,但他们确实喜欢这种“惯例”——即当现任者重掌大权时,回报率会略微高一些。民主党的循环虽优点多多,但往往会带来一些不确定因素——首先是谁会赢,其次是赢了的那个人接下来会做什么。不确定性往往会让金融家们感到紧张。

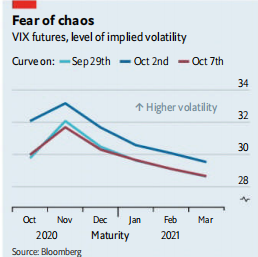

These jitters are most easily observed in VIX futures, derivatives that measure the level of volatility in stocks. Because periods of very high volatility are correlated with plunging share prices, VIX futures are often traded by investors as an insurance policy against losses in the S&P 500. Because there is usually more potential for volatility over longer time horizons, longer-dated VIX futures tend to be more expensive. They also tend to be dearer around uncertain events that are likely to prompt volatility, such as elections or even important central-bank meetings.

这种紧张在衡量股票波动性水平的衍生品VIX期货中表现最为明显。由于波动率非常高的时期与股价暴跌相连,所以VIX期货通常被投资者作为一种防范标准普尔500指数下跌的保单进行交易。由于在较长时期内波动的可能性通常更大,所以较长期的VIX期货往往更贵。而在可能引发波动的不确定事件(如选举,甚至是重要的央行会议)发生时,它们同样更贵。

译文由可可原创,仅供学习交流使用,未经许可请勿转载。

词语解释

1.hedge against 避免损失的措施

This money must be saved for the purpose of hedging against change in the exchange rate.

为防备汇率的变化,这笔钱必须存起来。

2.incumbent 在职者;现任者

George Bush, the incumbent, wants Congress to let oil firms drill in areas of Alaska and coastal waters that are currently off-limits for environmental reasons.

现任总统布什希望国会允许石油企业在阿拉斯加地区以及沿海水域钻油,这些地区目前由于环境原因禁止开采。